Authored by: Sarah Brown and Michael Innes

When the first disease-modifying therapies (DMTs) for Alzheimer’s disease received approval in 2021, there was widespread optimism. After decades of symptomatic-only treatments, these new therapies – beginning with Aduhelm and followed by Leqembi and Kisunla – promised a new era in tackling the root causes of the disease. Yet four years on, the uptake of these treatments remains lower than anticipated across global markets.

Why is this?

Our syndicated Therapy Watch data reveals a complex mix of clinical, infrastructural, and perceptual challenges is shaping the market’s evolution.

Using insights from an analysis of Therapy Watch Alzheimer’s, a market research study we have been conducting to track the Alzheimer’s market since Q1 2024, we outline some of the key factors influencing DMT adoption today.

The latest wave of the study draws on data from 783 physicians in the US, UK, Germany and Japan, who reported on over 6,000 early Alzheimer’s patients under their management, including 575 patients treated with DMTs. The study reveals some interesting shifts in the market and highlights the importance of keeping abreast of emerging trends in this space.

High hopes, high hurdles

While DMTs offer a scientifically validated mechanism for slowing Alzheimer’s progression – shown to reduce the rate of cognitive and functional decline by about a third – reimbursement remains a challenge, meaning potentially high out-of-pocket costs for patients. DMT treatment also comes with the risk of ARIA (amyloid-related imaging abnormalities), making physicians and patients cautious.

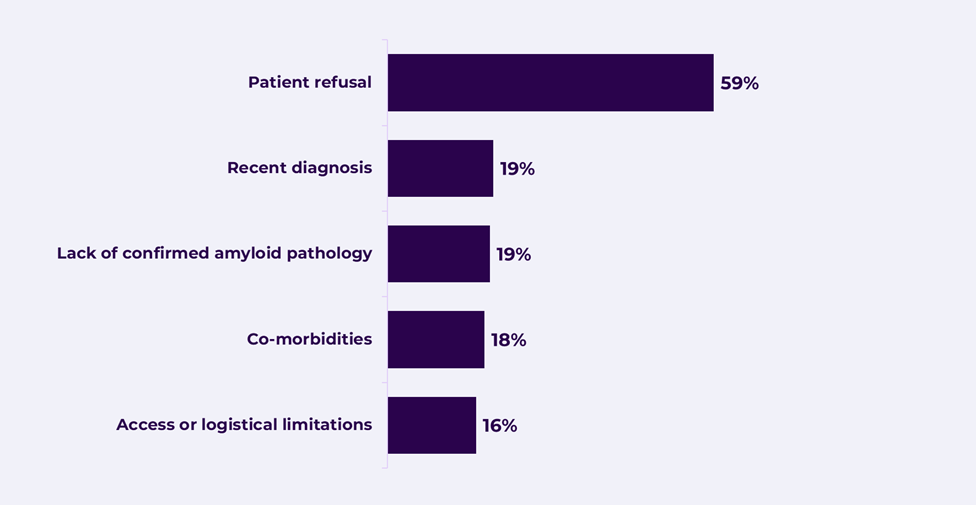

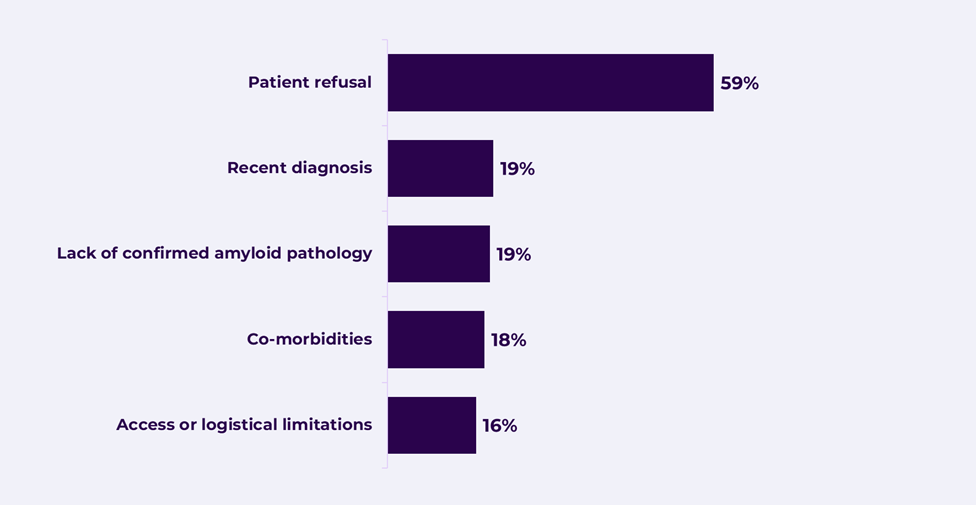

According to our data, patient refusal is now the number one reason for non-treatment across all markets. For many patients, these treatments appear to offer limited perceived benefit.

Figure 1. Reasons for not receiving treatment (physician provided) – US (n=599)

Diagnostics: The gatekeeper to treatment

Another barrier lies upstream: confirming a patient’s eligibility for DMTs. To prescribe these therapies, clinicians must confirm amyloid pathology, but the available diagnostic tests – PET scans, cerebrospinal fluid (CSF) tests, and emerging blood-based biomarkers – are not yet widely accessible.

Physicians cannot use DMTs without access to diagnostics. From our data, we’ve seen increases in testing rates across all methods since early 2024, but infrastructure still lags, especially outside of academic and memory clinic settings.

In many countries, neurologists lead the diagnostic process, with geriatricians also playing a role in some regions. Yet uptake of testing varies by physician type, country, and healthcare setting – further complicating treatment pathways.

Early adopters and patient profiles

Even where DMTs are being used, they tend to be prescribed to a narrow subset of the patient population. The study highlights a range of factors shaping which patients receive DMTs, including a clear leaning toward younger individuals with fewer comorbidities.

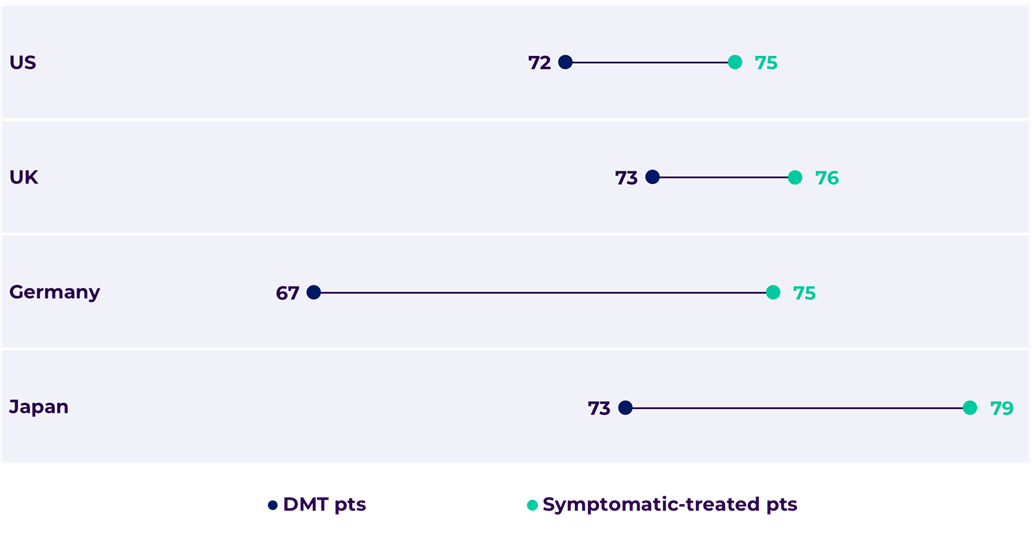

Younger patients have more to gain from slowing disease progression. According to our data, the average early Alzheimer’s patient is 74, but those on DMTs tend to be 3 to 8 years younger than those on symptomatic treatments only, depending on the market.

Figure 2. Average patient age by treatment class

US DMT n=323, symptomatic n=1487, UK DMT n=104, symptomatic n=788, DE DMT n=35, symptomatic n=806, JP DMT n=113, symptomatic n=750.

What pharma needs to monitor next

For companies with DMTs in development, we believe that several dynamics merit close attention:

- Biomarker infrastructure: Tracking the rollout and adoption of diagnostic testing capabilities will be critical. Without this, even the most effective treatments may struggle to gain traction.

- Physician awareness: Therapy Watch data shows that awareness of pipeline products remains low – yet interest in prescribing is high among those who are informed. Building awareness early could be key to driving uptake post-approval.

- Confidence and adoption curves: Understanding which physician types are early adopters can help shape tailored education and support strategies, particularly as prescribing confidence continues to evolve.

Looking ahead

As the Alzheimer’s DMT market continues to evolve, it is becoming clear that scientific progress alone is not going to be enough. To translate innovation into impact, stakeholders must address the systemic, psychological, and operational realities that shape real-world treatment decisions.

We believe rollout of biomarker testing, broader reimbursement, and stronger confidence among both physicians and patients, are all needed for growth in DMT uptake.

With more therapies on the horizon, understanding these market dynamics will be essential not only for successful launches, but for fulfilling the promise these treatments hold for millions of patients and families worldwide.

Contact us to find out more about our syndicated solutions.